International Trade Theories (Part ii)

1.THEORY OF ABSOLUTE COST ADVANTAGE

This theory was proposed by the Scottish economist namely Adam Smith in 1776. It is based on the principle of Division of labour. According to him application of this principle to international scenario helps the countries to specialise in the production of those goods in which they have cost advantage over other countries.

According to Adam Smith, every country should specialise in producing those products which it can produce at less cost than that of other countries and exchange these products with other products produced cheaply by other countries. Trade between two countries takes place when one country produces one product at less cost than that of another country and the other country has an absolute cost advantage over the first country in producing any other product.

ASSUMPTIONS OF THE THEORY

Adam Smith proposed the absolute cost advantage theory based on certain assumptions;

- Trade is between two countries.

- Only two commodities are traded.

- Free trade exists between the countries.

- The only element of cost of production is labour.

2.COMPARATIVE COST ADVANTAGE THEORY

Absolute cost advantage theory fails to explain the situation when one country has absolute cost advantage in producing many products. David Ricardo a British economist expanded the absolute cost advantage theory to clarify this situation and developed the theory of comparative cost advantage.

According to Comparative Advantage Theory, a country has a comparative advantage if it can produce a good at a lower opportunity cost than another country. A lower opportunity cost means it has to forego less of other goods in order to produce it.

Assumptions of the Theory

The theory of comparative cost advantage is based on several assumptions:

(a) Trade takes place between two countries only, say England and Portugal.

(b) They are trading with only two commodities, say, Cloth and Wine.

(c) The cost of production of these two goods in both the countries is expressed in terms of labour only.

(d) The production of these two goods in both the countries taken place at constant costs.

(e) There is no transport cost, or the transport cost, if any, is so small a part of product prices that it is ignored.

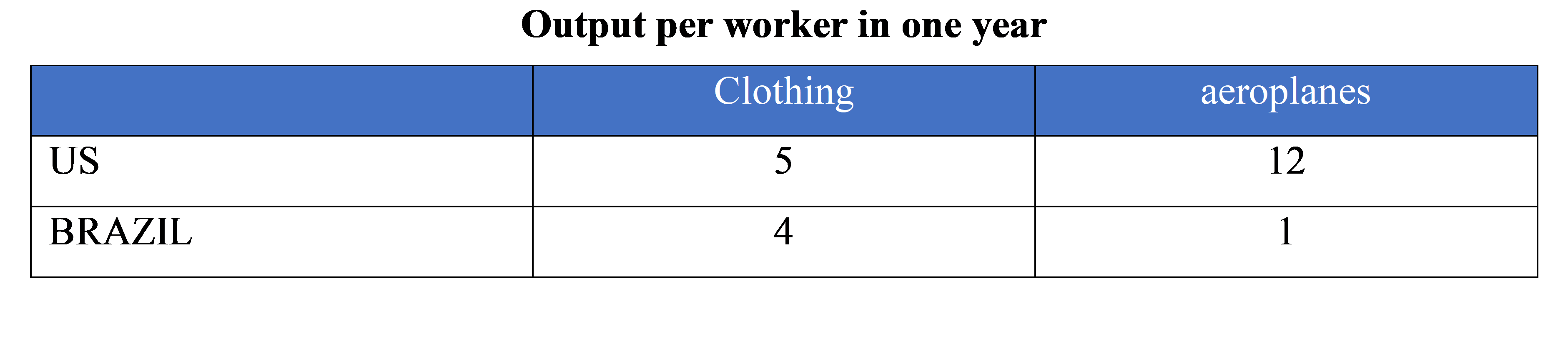

Given the above assumptions, the theory of comparative Cost Advantage can be explained with the following table as below:

The above Table shows that the US has an absolute advantage in producing clothing (5>4) and also aeroplanes (12>1). Brazil does not have an absolute advantage in anything. However, that doesn’t mean the US should be the only producer. We should look at comparative advantage based on opportunity cost.

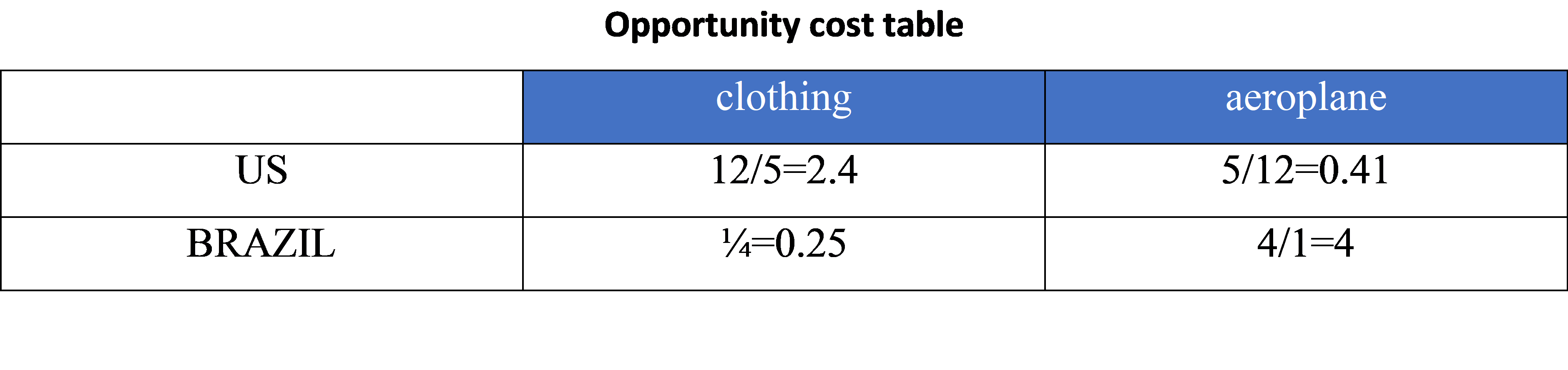

The above opportunity cost table shows that, the US has a comparative advantage in producing aeroplanes. This is because the opportunity cost of producing aeroplanes (5/12=0.41) is lower than that of Cloth (12/5=2.4) in US. Therefore, US should specialise in producing aeroplanes even though it has absolute advantage in both cloth and aeroplanes.

In contrast, Brazil has a comparative advantage in producing Cloth. Brazil produces clothing, the opportunity cost is 1/5 = 0.25 aeroplanes as the one shown in above table. This is because the opportunity cost of producing cloth (¼=0.25) is lower than that of aeroplanes (4/1=4) in Brazil.

Therefore, Brazil should specialise in producing clothing even though it doesn’t have an absolute advantage.

Therefore, we conclude that based on comparative cost advantage analysis, both US and Brazil will be benefited by trading each other.

Criticisms of the Theory

As with many other economic ideas there are criticisms to be levelled at comparative cost advantage theory:

(i) It is much more complicated in the real world in deciding in which goods countries have a comparative cost advantage. This is so because there are a large number of goods and many countries.

(ii) The theory ignores the effects of transport costs. However, once transport costs are added any comparative advantage may be lost.

(iii) Modern theories, no longer based on Ricardo’s labour theory, have established that the only necessary condition for the possibility of gains from trade is that price ratios should differ between countries.

(iv) Ricardo ignored the role of demand completely and explained trade from supply side.

(v) Ricardo’s analysis is based on the labour theory of value as costs are expressed in terms of labour hours. However, the classical labour theory itself has lost its relevance.

(vi) The theory applied their principle in case of trade with two countries only and with two commodities only. So, the principle has a limited scope of application in practice. It cannot explain multi-lateral trade.

3. Heckscher-Ohlin Theory (Factor Proportions Theory):

The theories of Smith and Ricardo didn’t help countries determine which products would give a country an advantage. Both theories assumed that free and open markets would lead countries and producers to determine which goods they could produce more efficiently. In the early 1900s, two Swedish economists, Eli Heckscher and Bertil Ohlin, focused their attention on how a country could gain comparative advantage by producing products that utilized factors that were in abundance in the country. Their theory is based on a country’s production factors —land, labor, and capital, which provide the funds for investment in plants and equipment. They determined that the cost of any factor or resource was a function of supply and demand. Factors that were in great supply relative to demand would be cheaper; factors in great demand relative to supply would be more expensive. Their theory, also called the factor proportions theory, stated that countries would produce and export goods that required resources or factors that were in great supply and, therefore, cheaper production factors. In contrast, countries would import goods that required resources that were in short supply, but higher demand. } For example, China and India are home to cheap, large pools of labor. Hence these countries have become the optimal locations for labor-intensive industries like textiles and garments.